The Challenges of Association Accounting in Litigation

Because most association unit owners usually pay on time, generally, association accountings are not highly scrutinized on a day-to-day basis. However, when disputes regarding payment arise with an owner, or an account becomes so far behind that litigation is necessary, it becomes increasingly important that unit owner ledgers are without flaws.

Attorneys for debtors are quick to point out any errors in accounting, as this will demonstrate how unreliable the accounting is in its totality. Moreover, errors in accounting or misapplication of payments will often cause a magistrate or judge to become critical of record keeping and the trustworthiness of the Association and its representatives in general.

For these reasons, although it is a high volume business, property management companies and board members in charge of record keeping for the Association must be sure to have exquisite attention to detail, consistency, and to properly credit payments to accounts of their owners.

Dates of Payment Posting

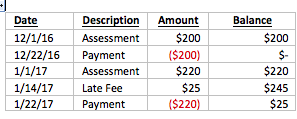

On an owner ledger, payments should be posted on the date they were received, rather than the date they were actually input into the computer system or deposited. It becomes very difficult for anyone to explain to a debtor, opposing counsel, magistrate or judge the actual date a payment was received and whether a late fee was warranted if this is not done. For example, take a look at a recent set of payment postings, with the grace period ending on the 10th of the month:

If we attempt to explain this to a debtor or a Magistrate or Judge, it looks like we charged a late fee on one payment but not the other, and that the payments were made on the same day each month. The explanation we received in the above scenario was that the December payment was made on December 10, and the January payment was made on January 15, and that the Association keeps envelopes or notes regarding the actual date of payment. Despite the payments being shown as credited on the same day of the month, they were actually made by the owner on the 10th of one month and the 15th of the other month. The accounting person used the posting date rather than the actual date payment was received. This inaccurate accounting requires an exponential amount of explanation in court. The accounting records must accurately record when payments were actually received.

Lockbox Payments

Many Associations take advantage of their bank’s lockbox payment systems. We understand this is a cost effective and viable way for the Associations to handle payments. Once the payment is made into a lockbox, it automatically shows as a credit on the owners account, generally 24-48 hours later. The disadvantage of this type of system is that the wrong owner or unit may be credited with the payment.

If the Association uses a lockbox payment system, it is essential that the person handling

accountings be alerted when substantial payments come in. Our Firm has inadvertently commenced legal actions, even filed foreclosure, after a substantial payment or payoff amount has come in, due to a failure to notify our office that such a payment was received. Commencing an action when there is no longer a debt may result in claims for negligence against the Association, potential Fair Debt Collection Practices Act violations against the Association and property management company, and numerous other suits.

Payment Application Based On Ohio Law

For both condos and HOA’s, unless it specifically states otherwise in the governing documents, payments should be applied in the following order, with the oldest balance in each category first:

1. Interest;

2. Late Fees;

3. Collection costs

(attorney fees, court costs, etc.); and then

4. Principal amounts due for enforcement assessments, regular assessments and special assessments.

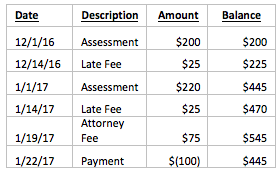

To illustrate, assume the monthly fee for 2016 is $200, with an increase on January 1, 2017, to $220.00, with a late fee of $25.00 if paid late (after 10 days):

Of the $100.00 payment, $50.00 was credited to late fees, with the remaining $50.00 credited to the attorney fees. You should not credit the full $100.00 to the maintenance assessment. Use the order set forth above—first to late fees, then to attorney fees, then to the maintenance assessment, starting with the oldest balance first. The outstanding $445.00 balance consists of legal fees of $25.00 and maintenance fees of $420.00.

Bill Back of Attorney Fees

Once the Association receives an invoice for attorney fees, please bill back the attorney fee balance for that owner to the owner’s account, unless we have placed “Do Not Bill Back” listed on the bill. The attorney fees must be billed back to owner’s account within 30 days of the receipt of our bill, at the latest. Failure to bill back these fees may result in a court refusing to award said fees in litigation for collection or enforcement actions.

If there are any questions regarding these highly recommended procedures, please let our office know.